Can a health insurance company require a certain lifestyle? It’s a question that many people ponder when considering their options for health coverage. In a world where personal choices play a significant role in our overall well-being, it’s only natural to wonder if insurance companies can dictate the way we live our lives. After all, health insurance is supposed to protect us and provide peace of mind, but can it also impose restrictions on our lifestyle choices? Let’s dive into this intriguing topic and explore the boundaries of health insurance requirements.

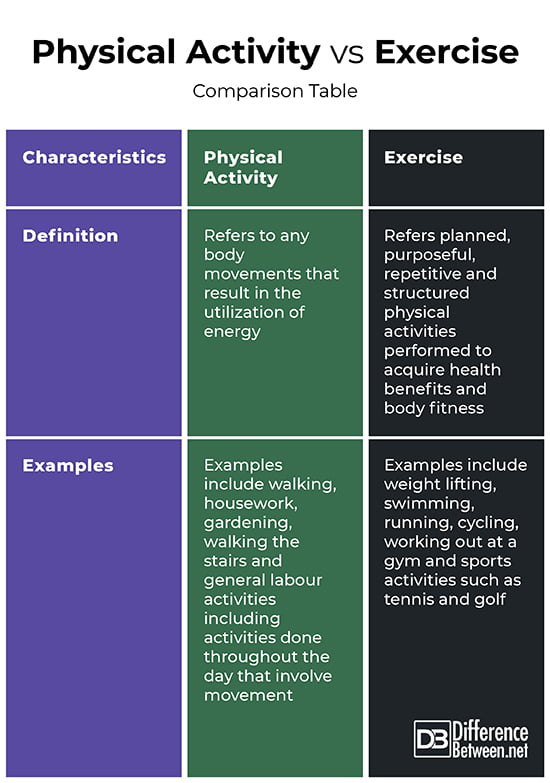

When it comes to health insurance, there are certain factors that companies take into consideration. These include age, pre-existing conditions, and lifestyle choices. While age and pre-existing conditions are relatively straightforward, the idea of a health insurance company scrutinizing our lifestyle may seem intrusive. However, it’s important to understand that insurance companies carefully assess risk factors to determine premiums and coverage. This evaluation often involves analyzing an individual’s lifestyle choices, such as smoking, excessive alcohol consumption, or participation in high-risk activities.

While health insurance companies can consider lifestyle factors, they cannot outright require a certain lifestyle. It is not within their power to dictate how we live our lives. However, they can use these factors as a basis for determining coverage and premiums. This approach is rooted in the principle of risk management. Insurance companies aim to mitigate their financial risks by adjusting coverage and pricing based on an individual’s lifestyle choices. So, while you have the freedom to live your life as you choose, it’s essential

Can a Health Insurance Company Require a Certain Lifestyle?

Health insurance is an essential aspect of life, providing financial coverage for medical expenses. However, there has been a debate surrounding whether health insurance companies can require individuals to adopt a certain lifestyle in order to receive coverage. This article aims to explore this topic and shed light on the different perspectives surrounding it.

The Role of Health Insurance Companies

Health insurance companies play a crucial role in the healthcare system. Their primary objective is to provide coverage for medical expenses and ensure that individuals have access to necessary healthcare services. However, in recent years, there has been a growing concern about the influence of insurance companies on the lifestyle choices of individuals.

On one hand, some argue that health insurance companies have the right to require individuals to adopt a certain lifestyle. They argue that by promoting healthy habits such as regular exercise, a balanced diet, and abstaining from harmful substances like tobacco, insurance companies can lower healthcare costs and promote overall well-being. These proponents believe that it is fair for insurance companies to incentivize healthy behaviors by offering lower premiums or additional benefits to those who meet certain health criteria.

The Ethics of Lifestyle Requirements

On the other hand, there is a strong opposition to the idea of health insurance companies imposing lifestyle requirements. Critics argue that such requirements infringe upon individual autonomy and personal choices. They believe that individuals should have the freedom to make their own decisions about their lifestyle without fear of being denied health insurance coverage.

Imposing lifestyle requirements can also lead to discrimination and unequal access to healthcare. Not everyone has the same opportunities or resources to adopt a particular lifestyle. For example, individuals living in low-income communities may not have access to healthy food options or safe areas for exercise. Requiring a certain lifestyle can disproportionately affect marginalized communities and further exacerbate existing health disparities.

Benefits and Drawbacks of Lifestyle Requirements

When considering the question of whether health insurance companies can require a certain lifestyle, it is important to weigh the potential benefits and drawbacks.

On one hand, lifestyle requirements can incentivize individuals to adopt healthier habits, leading to improved overall health outcomes. By promoting preventive measures, insurance companies can potentially reduce the burden on the healthcare system and lower costs for everyone. These requirements can also encourage individuals to take responsibility for their own health and make positive changes in their lifestyle.

However, there are also drawbacks to imposing lifestyle requirements. It can create a slippery slope where insurance companies may start dictating various aspects of individuals’ lives. This raises concerns about privacy and personal freedom. Additionally, lifestyle requirements may not necessarily guarantee improved health outcomes. There are numerous factors that contribute to a person’s health, and it is not always within their control.

Transparency and Accountability

If health insurance companies were to implement lifestyle requirements, it is crucial to ensure transparency and accountability. Clear guidelines should be established regarding the specific lifestyle criteria and how they are assessed. It is important to avoid subjective judgments and biases when determining eligibility based on lifestyle choices. Transparency will help maintain trust between individuals and insurance companies and ensure fairness in the process.

In conclusion, the question of whether health insurance companies can require a certain lifestyle is a complex and contentious issue. While some argue that it is within the rights of insurance companies to incentivize healthy behaviors, others highlight the importance of individual autonomy and the potential for discrimination. Striking a balance between promoting healthy habits and respecting personal choices is essential. It is crucial for ongoing discussions and debates to address the ethical implications and potential consequences of lifestyle requirements in the context of health insurance.

Key Takeaways: Can a Health Insurance Company Require a Certain Lifestyle?

- Health insurance companies cannot require a certain lifestyle as a condition for coverage.

- Insurance companies can, however, offer incentives for healthy behaviors, such as discounts or rewards.

- It is important to read the policy carefully to understand any requirements or limitations.

- Health insurance is designed to protect individuals from unexpected medical expenses.

- If you have concerns about your insurance coverage, it’s best to consult with a professional or contact your state insurance department.

Frequently Asked Questions

Can a Health Insurance Company Require a Certain Lifestyle?

When it comes to health insurance, many people wonder if insurance companies can require them to adopt a certain lifestyle. Let’s explore this question and understand the role of health insurance companies in promoting healthy living.

First and foremost, health insurance companies cannot force individuals to adopt a specific lifestyle. They cannot require you to eat a certain diet, exercise a certain amount, or engage in any particular activity. Your personal choices and freedom are protected by law, and insurance companies cannot infringe upon them.

However, it’s important to note that health insurance companies may incentivize healthy behaviors. They can offer discounts or rewards for participating in wellness programs, quitting smoking, or maintaining a healthy weight. These incentives are designed to encourage individuals to make positive lifestyle choices that can lead to better overall health and lower healthcare costs for both the individual and the insurance company.

Are there any legal restrictions on health insurance companies requiring a certain lifestyle?

Health insurance companies are subject to legal restrictions regarding the requirement of a certain lifestyle. The Affordable Care Act (ACA) prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions or genetic information. This means that insurance companies cannot discriminate against individuals based on their lifestyle choices or health conditions.

However, insurance companies can use incentives and rewards to encourage healthy behaviors. They can offer lower premiums or additional coverage for those who engage in activities that promote good health. These incentives are voluntary and individuals have the choice to participate or not. It’s important to read and understand the terms and conditions of your health insurance policy to know what incentives are available to you.

How can health insurance companies promote a healthy lifestyle without requiring it?

Health insurance companies play a crucial role in promoting a healthy lifestyle without requiring it. They can provide resources and support for individuals to make informed decisions about their health. This can include access to preventive care services, such as screenings and vaccinations, which can help detect and prevent potential health issues before they become serious.

Additionally, health insurance companies can offer wellness programs and services that educate and empower individuals to make healthier choices. These programs may include nutrition counseling, fitness classes, and mental health support. By offering these resources, insurance companies can encourage individuals to take proactive steps towards improving their health without imposing any requirements.

What should I do if I feel my health insurance company is unfairly requiring a certain lifestyle?

If you believe your health insurance company is unfairly requiring a certain lifestyle or discriminating against you based on your personal choices, it’s important to seek guidance and support. Contact your state’s insurance department or seek legal advice to understand your rights and options.

It’s also helpful to review your health insurance policy and understand the terms and conditions. If you have concerns or questions, reach out to your insurance company directly for clarification. Open communication can often help resolve any misunderstandings or address any issues you may have.

What are the benefits of health insurance companies promoting a healthy lifestyle?

Health insurance companies promoting a healthy lifestyle can have numerous benefits for individuals and society as a whole. By encouraging healthy behaviors, insurance companies can help prevent chronic diseases, reduce healthcare costs, and improve overall population health.

Individuals who adopt a healthy lifestyle may experience improved physical and mental well-being, leading to a better quality of life. Moreover, preventive care and early intervention can help detect health issues at an early stage when they are often easier to treat and manage.

Lifestyle choices could raise your health insurance rates

Final Thoughts

So, can a health insurance company require a certain lifestyle? After delving into the topic and exploring different perspectives, it becomes evident that while health insurance companies can incentivize healthy behaviors, they cannot outright require a certain lifestyle from their policyholders. This conclusion is based on ethical considerations, legal regulations, and the principle of individual autonomy.

While it is understandable that insurance companies want to encourage healthy habits to reduce the risk of costly medical treatments, forcing policyholders into specific lifestyles would infringe upon personal freedoms. People have the right to make their own choices regarding their health and well-being. Instead of imposing lifestyle requirements, insurance companies can provide incentives such as lower premiums or wellness programs to motivate individuals to adopt healthier behaviors.

In conclusion, the idea of health insurance companies mandating a certain lifestyle is not supported by legal and ethical guidelines. It is important to strike a balance between encouraging healthy habits and respecting individuals’ autonomy. By promoting wellness initiatives and incentivizing healthy behaviors, insurance companies can contribute to a healthier society while still upholding personal freedom and choice. Let us continue to prioritize individual agency and well-being as we navigate the complex world of health insurance.